Cardio Diagnostics Holdings, Inc. (CDIO) is a publicly-traded company that provides diagnostic testing and monitoring services for heart-related conditions. The company offers a range of non-invasive cardiovascular tests, including electrocardiograms (ECGs), echocardiograms, and holter monitoring. CDIO was founded in 2015 and is headquartered in Arizona, USA.

Strengths and Weaknesses

One of the key strengths of CDIO is its focus on non-invasive cardiovascular testing, which is becoming increasingly popular among patients and physicians due to its lower risk and cost compared to invasive procedures. CDIO's tests are also designed to be quick and easy to administer, which can improve patient compliance and help physicians make faster and more accurate diagnoses.

CDIO has also been expanding its reach through partnerships and acquisitions. In 2019, the company acquired Tri-Valley Cardiology, a cardiovascular practice in Arizona, which has helped to increase CDIO's patient volume and revenue. CDIO has also partnered with several major healthcare providers, including Banner Health and United Healthcare, which has helped to raise the company's profile and expand its network of referral sources.

Despite these strengths, there are some potential weaknesses to consider when analyzing CDIO's business. One major risk is the highly competitive nature of the healthcare industry, particularly in the field of diagnostic testing. CDIO faces competition from a range of other companies offering similar services, including larger players like Quest Diagnostics (DGX) and LabCorp (LH). This competition could make it difficult for CDIO to maintain market share and pricing power over the long term.

Another potential challenge for CDIO is the ongoing regulatory environment for healthcare companies. CDIO is subject to a range of federal and state regulations related to healthcare operations, privacy, and billing practices. These regulations can be complex and constantly changing, which can create compliance challenges and increase costs for the company.

Overall, CDIO's focus on non-invasive cardiovascular testing and strategic partnerships and acquisitions are positive factors for the company. However, the highly competitive nature of the industry and the regulatory risks should also be considered when analyzing CDIO's business.

Deeper Dive

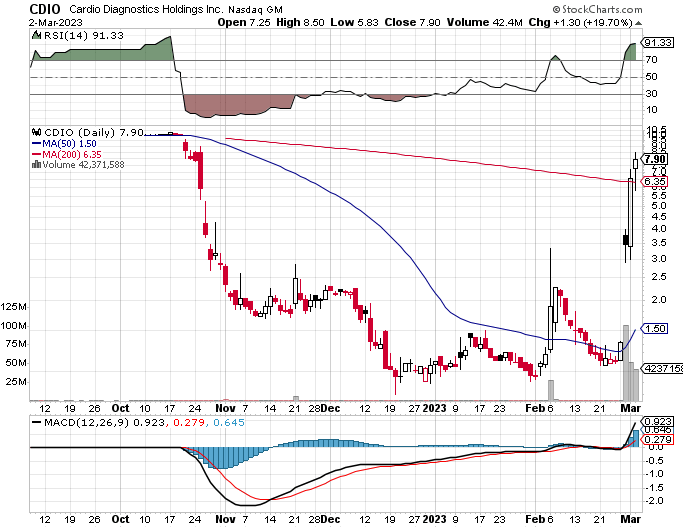

Assuming you've gotten this far, let's dive a little deeper into this little company. They went public via a SPAC merger with Mana Capital Acquisition Corp and started trading on Nasdaq in late October of 2022. Taking a look at their chart you can see that they immediately started nose diving. The market has not been kind to SPAC mergers like these.

One thing I find interesting is the unusual short sales activity over the last few months. This tool is available to subscribers.

Anyway, this stock showed up on that list on the dates where I've marked with an arrow on this next chart.