Cassava Sciences, Inc. (SAVA)

Cassava is based in Austin, TX and is a clinical stage company making drugs for neurodegenerative diseases. Their mission is to detect and treat Alzheimer's disease. Now that's a lofty goal.

The biotech sector is littered with the bodies of companies that have tried and failed to do this exact thing. If and when a company manages to be successful, the returns will be phenomenal. Recent years have not been kind to biotechs so the market is definitely in show-me mode.

Roller Coaster

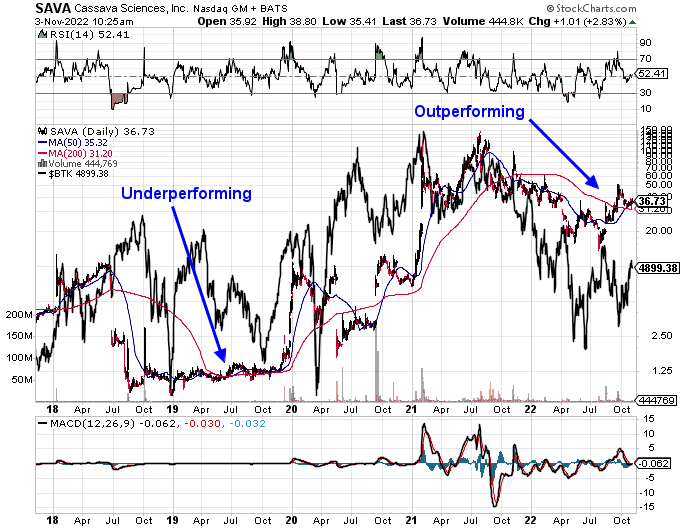

As one can imagine, this stock has been nothing short of a roller coaster as its prospects have ebbed and flowed regarding the treatment of Alzheimer's disease. For a long time it lagged the broader biotechnology index, BTK. Late 2018 and most of 2019 were particularly rough as the stock languished and underperformed. Then in December of 2019 they released some promising news and the stock finally started to move only to crash back down in May of 2020 when they missed their primary endpoint in one of their studies. It plunged 74% that day.

Early 2021 saw some positive news and the stock rocketed upward again, and the company was able to raise a lot of cash, which strengthened their balance sheet considerably. I believe it is this move that helped to finally stabilize the price. It has been relatively outperforming biotech in general ever since.

The Latest

There has been a lot of back and forth regarding accusations of data manipulation and fraud. New York-based law firm Labaton Sucharow requested that the FDA halt clinical studies of Cassava’s Simufilam. They claimed that the quality and integrity of the company's research were questionable. It also appears that their clients were short the stock. Now isn't that a conundrum? Anytime I see this kind of chicanery from shorts it gets my attention. Particularly when their claims seem to have no merit. The Journal of Prevention of Alzheimer's Disease found "no convincing evidence of data manipulation" in the company's 2020 paper on Simufilam. Maybe with the stock's outperformance the shorts were hurting and decided to play dirty? I have no idea, but it does make you wonder. They wouldn't ever do that, would they?

Anyhoo

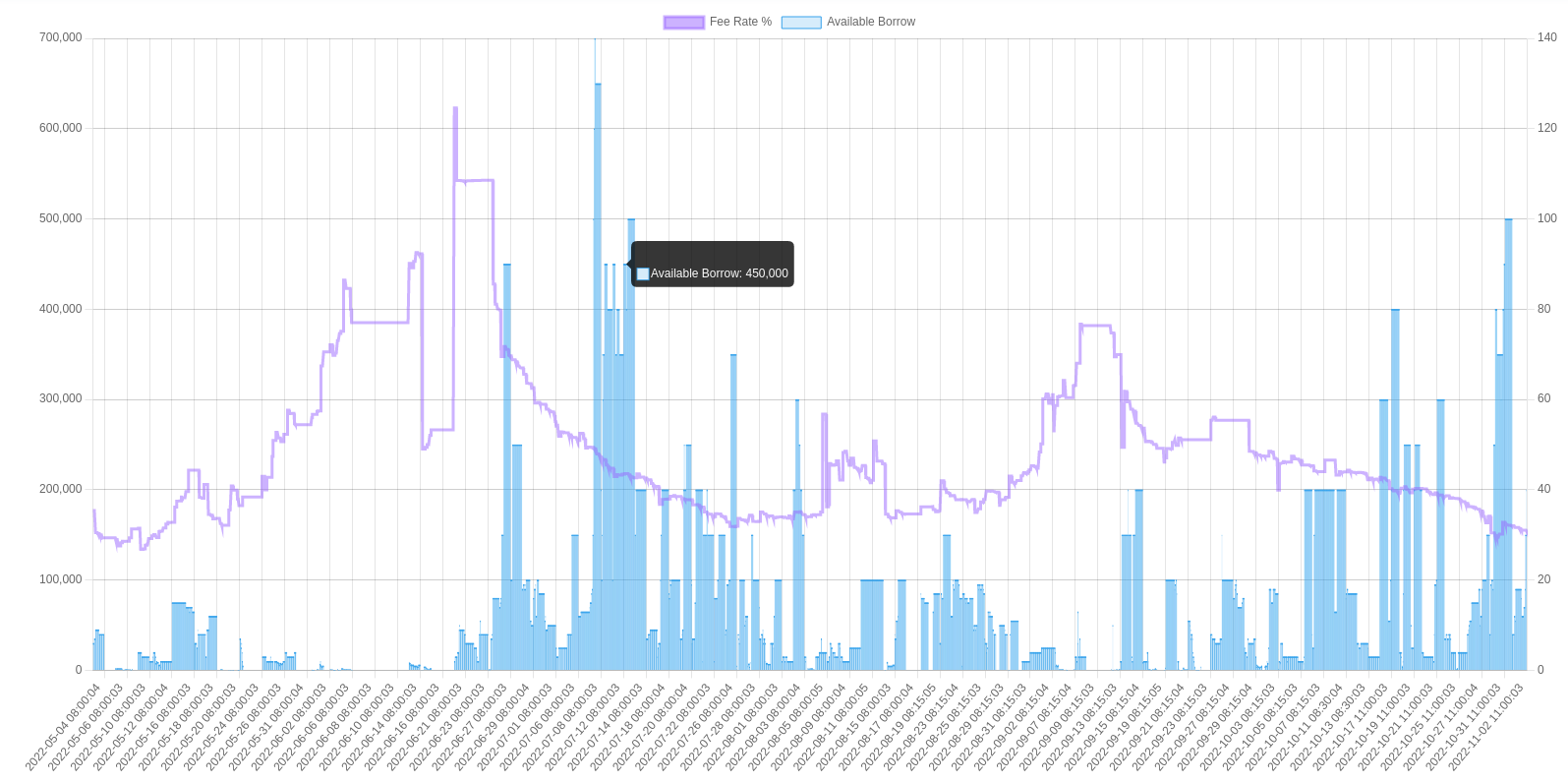

Given the pre-revenue nature of this company, it is highly speculative. There's also the strangeness of the fight with the shorts. Just today the company announced that they have filed a lawsuit against the individuals responsible for what they call a "short and distort" campaign against the company. It does warm my heart to see a relatively small company stand up to what appear to be baseless claims from the shorts. Those short positions must have been getting pretty painful to hold with pretty exorbitant fee and rebate rates. Looking back six months, the fee rate was in the triple digits back in June of 2022, and it still punitively high now. And given the size of the float there aren't very many shares to short either.

Financials

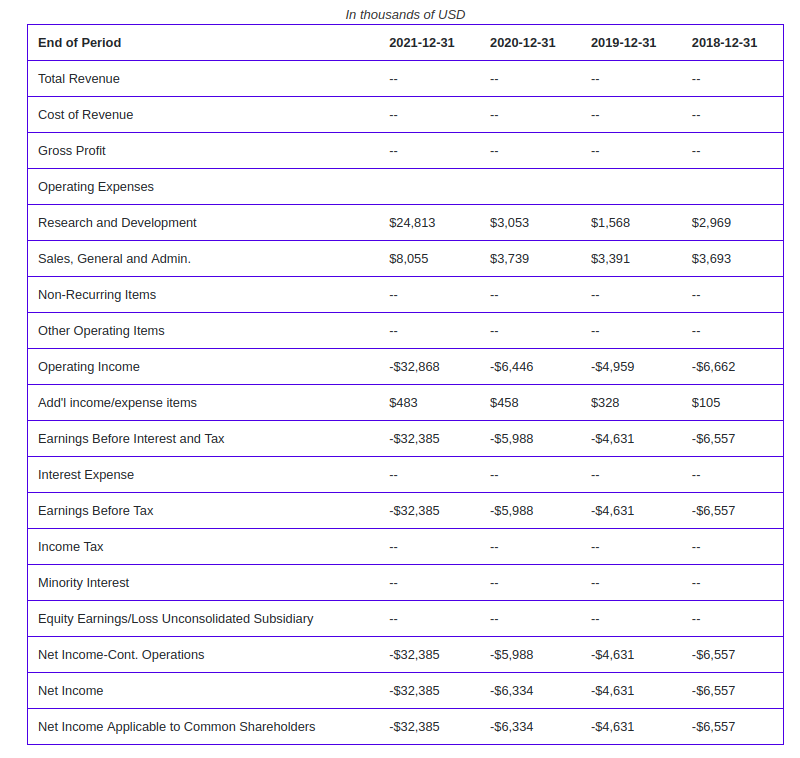

As I mentioned before, this company is pre-revenue. That means no sales yet. None. Here's their income statement in all its glory:

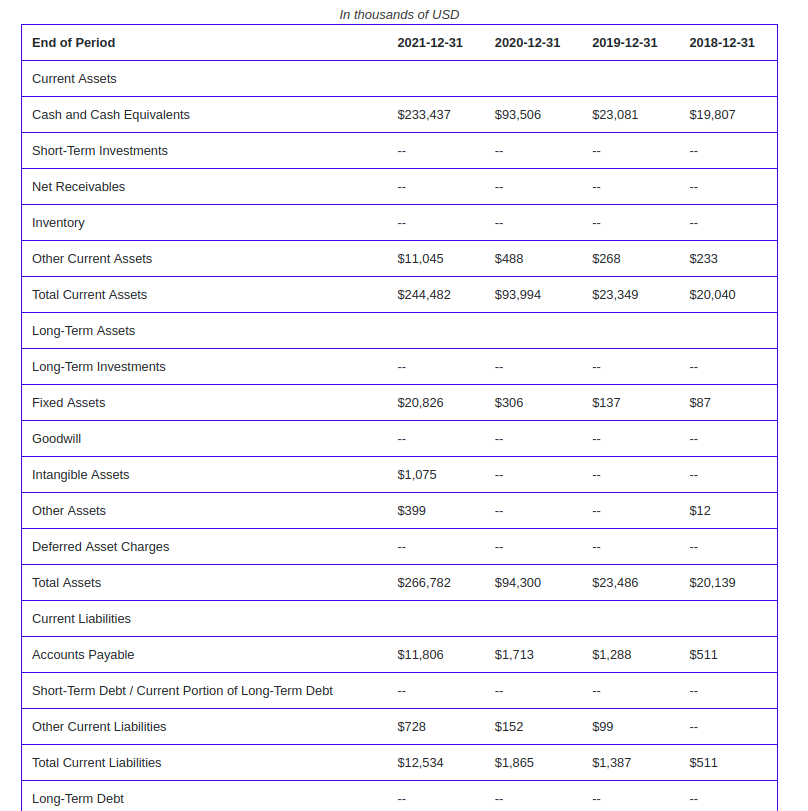

They are burning through cash like a drunken sailor. The good news is that they have quite a bit of it. The relevant portion of their balance sheet is below:

They have quite a long runway before they need to raise cash again, and the stock price seems to reflect this.

Bottom Line

I like this stock as a highly speculative long play. I do not own any shares at the moment, and given the current state of the market, I probably won't buy any time soon, but it is definitely on my radar for the coming weeks and months.