Arrival (ARVL)

Founded in 2015 and headquartered in Luxembourg, Arrival is yet another EV maker. Their business model is a bit different as they use what they call microfactories to build their vehicles. The idea here is to reduce some of the prohibitive capital costs associated with manufacturing conventional vehicles. Notably, the metal stamping line, body welding line, and paint shop are eliminated in Arrival's microfactories. They make their body panels using a mold and a combination of glass fiber and woven polypropylene. This makes them cheap yet strong and resistant to corrosion. They then mount these panels to a vehicle frame made mostly of extruded aluminum. Also very cheap and easy. There is also no production line like in a typical vehicle factory. They use what they call autonomous mobile robots or AMRs that move independently through the factory to do their various jobs. They communicate over the network and are able to work together to do larger tasks, and most importantly they are able to learn over time using AI to work more efficiently. All of this makes the company extremely flexible. They can build different types of vehicles in the same space and they don't need a super specialized building to do it. And the artificial intelligence piece is attractive in that it goes into everything they do making the entire operation more efficient over time. As an investor, what's not to love?

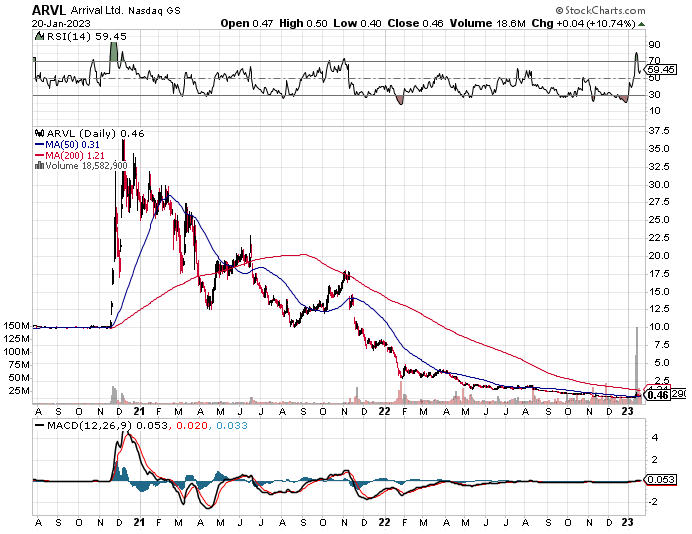

We can start with the stock price.

During the speculative frenzy of late 2020 and after Arrival announced its intention to merge with CIIG Merger Corp the stock went nuts, trading as high as $37/share. That was a $23 billion market cap at the time for a company with no revenue. Yeah. Anyway, by the time the SPAC merger was completed in March of 2021 it was valued at $22/share or about $13 billion. It mostly went sideways to down for the remainder of the bull market, but they have struggled in 2022 like so many other companies as the speculative froth has come off the stock market.

Here's a chart of their entire illustrious time as a public company.

Going Concern

Before I go any further I must mention the going concern note in their annual report filed at the end of April, 2022 for the year ended December 31st, 2021. They say: "Whilst Arrival has sufficient funds to execute its near term business plan, including starting production in 2022 for its first two vehicles, Bus and Van. Management does plan to raise additional capital to execute its long-term business plans, including the deployment of additional microfactories and vehicle platforms. Arrival cannot be certain that additional funds will be available to it on favourable terms when required, or at all."

It's not unusual for a small, capital-intensive company like Arrival to include a note like this. Duh, right? If they can't raise money, they might not be able to continue.

Opportunity

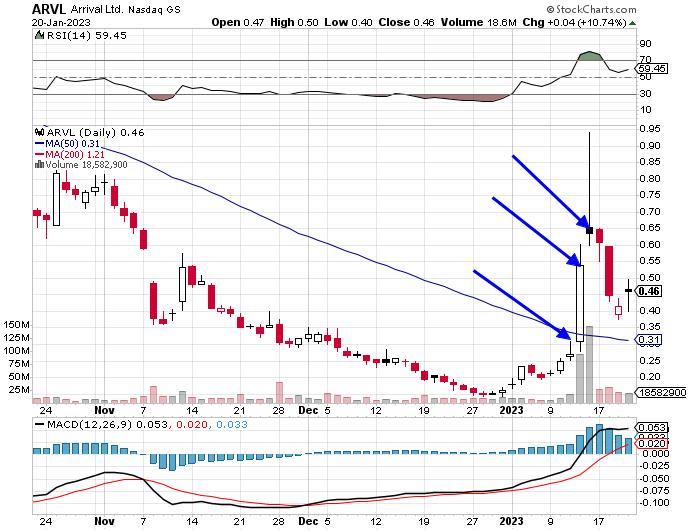

As the US stock market comes out of its bear market there are opportunities to be had, and I think Arrival is no exception. The bears have had their way with this one, but now I think it's time for the bulls to have some fun. Here's a more recent chart with some notes added.

We have something that we call our Unusual Short Sales Activity tool that scans every day for, you guessed it, unusual short sales activity. Arrival showed up on this list on 1/11, 1/12, and 1/13 as shown by the arrows on the chart above. The low at the end of last year was $0.14 and the spike on 1/13 was to $0.94, which was over 6x in the span of about 2 1/2 weeks. Now that's quite a move, and there was no news to account for it. When I see a spike like that with an unusual amount of short selling it definitely piques my interest. But the really important information comes after the fact to see how the stock reacts. In this case, it is acting bullish, at least so far.

No position -- yet

I am watching this highly speculative stock very closely. It looks to me like the bottom is in and the bulls are back in control. I will more than likely pick up what I consider to be some cheap stock in here over the next week or so.