Guardforce AI Co., Limited (GFAI)

Guardforce AI Co., Limited (GFAI) is a Hong Kong-based company that specializes in providing comprehensive security solutions using advanced technology. Founded in 2017, the company has quickly gained recognition for its innovative approach to security, which involves the use of artificial intelligence, machine learning, and other cutting-edge technologies.

Product Lineup:

GFAI's product lineup consists of various security solutions that cater to different needs and industries. These products can be broadly classified into three categories:

Smart Security: This category includes products that use advanced technology to enhance physical security. GFAI's smart security products include intelligent CCTV systems, facial recognition systems, and access control systems. These systems use AI and machine learning to identify potential threats and provide real-time alerts to security personnel.

Cybersecurity: With the increasing reliance on technology in business, cybersecurity has become a critical concern for all organizations. GFAI's cybersecurity products include threat detection and response systems, penetration testing, and risk assessments. These solutions help organizations identify and mitigate potential cyber threats before they can cause any harm.

Cash Management: GFAI's cash management solutions help businesses manage their cash flow efficiently and securely. These solutions include cash-in-transit services, smart safes, and cash management software. With these solutions, businesses can optimize their cash handling processes and reduce the risk of theft or fraud.

Successes:

Since its inception, GFAI has been successful in securing partnerships with several notable organizations in Hong Kong and the Asia-Pacific region. These partnerships have helped the company expand its reach and establish itself as a leading provider of advanced security solutions.

In 2020, GFAI was awarded the "Outstanding Security Equipment Manufacturer" award by the Hong Kong Security Association. This recognition is a testament to the company's commitment to innovation and excellence in the field of security.

GFAI's smart security products have been particularly successful in helping businesses enhance their physical security. For example, GFAI's intelligent CCTV systems have helped a major Hong Kong retailer reduce theft by 50%. Similarly, GFAI's facial recognition systems have helped a leading financial institution improve access control and reduce the risk of unauthorized access.

Failures:

While GFAI has been successful in many aspects, the company has also faced some challenges and failures. One of the biggest challenges has been the high cost of implementing advanced security solutions. Many businesses in the region may be hesitant to invest in such solutions due to budget constraints.

Another challenge has been the perception of privacy concerns associated with GFAI's facial recognition technology. While facial recognition can provide enhanced security, it also raises concerns about privacy and potential abuse of the technology. GFAI has taken steps to address these concerns by implementing strict data privacy policies and providing transparency about its facial recognition technology.

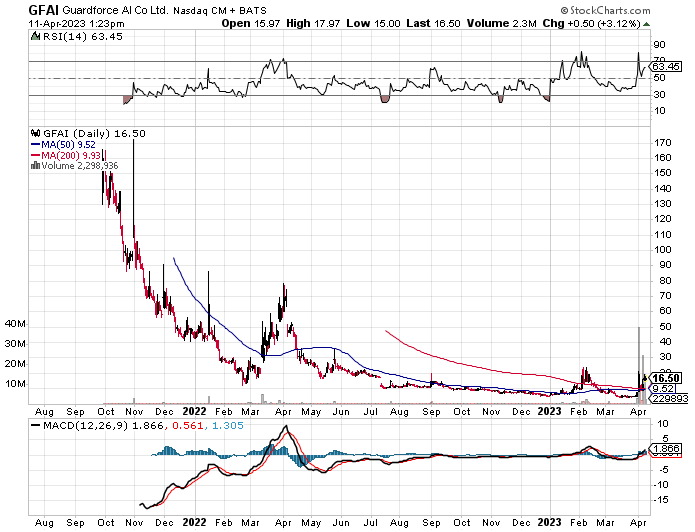

Chart:

Their current ratio (total current assets/total current liabilities) suggests that they may need to raise cash soon. Be aware of the potential for this.

Conclusion:

Overall, GFAI is a company that has shown great promise in the field of security. Its innovative approach, which combines advanced technology with traditional security practices, has helped it secure partnerships with several notable organizations in the region. While the company has faced challenges in terms of cost and privacy concerns, it has taken steps to address these issues and ensure that its solutions are effective and ethical. With its continued focus on innovation and excellence, GFAI is well-positioned to become a leading provider of security solutions in the Asia-Pacific region and beyond. In terms of the stock, I would consider this company to be highly speculative. There will be huge spikes as this is an extremely low float stock of 1.18M shares, but the financials suggest that at least for now the trend will continue down.