Infobird Co., Ltd (IFBD)

Infobird Co., Ltd (IFBD) is a Chinese-based technology company that provides a range of innovative customer engagement solutions for businesses worldwide. The company was founded in 2001, with its headquarters located in Beijing, China. Infobird is a leading provider of Software as a Service (SaaS) solutions that help businesses to streamline their customer engagement processes, enhance customer satisfaction, and drive growth.

History

Infobird was established as a technology services company focused on developing and deploying enterprise-level customer relationship management (CRM) systems. Over the years, the company has expanded its service offerings to include a range of innovative SaaS solutions that help businesses to improve customer engagement and achieve their growth objectives. Infobird has established itself as a leading provider of cloud-based customer engagement solutions in China, with a growing presence in the global market.

In 2021, Infobird successfully completed its initial public offering (IPO) on the Nasdaq Global Market, raising approximately $25 million in capital. The IPO was a significant milestone for the company, marking its transition from a privately-held entity to a publicly-traded company. The funds raised through the IPO will enable the company to invest in research and development, expand its product offerings, and drive growth in both domestic and international markets.

Strengths

Infobird's strengths lie in its innovative customer engagement solutions and its ability to adapt to changing market trends. The company has developed a range of SaaS products that help businesses to improve their customer engagement processes, increase customer satisfaction, and drive growth. Infobird's solutions are designed to be scalable and customizable, making them suitable for businesses of all sizes and industries.

Another strength of Infobird is its strong market position in China. The company has a significant market share in China's customer engagement market and is well-positioned to capitalize on the growing demand for cloud-based solutions in the region. Infobird has also established a strong brand presence in the global market, with a growing customer base in North America.

Weaknesses

However, despite its strengths, Infobird Co., Ltd also has some weaknesses that could potentially impact its business operations. One of the most significant weaknesses is the company's heavy reliance on the Chinese market. Although Infobird Co., Ltd has expanded its customer base to include clients outside of China, the majority of its revenue still comes from the domestic market. This over-dependence on a single market leaves the company vulnerable to changes in the Chinese economy or regulations.

Another weakness is the company's lack of diversification in its product offerings. Infobird Co., Ltd primarily focuses on customer engagement solutions, which limits its potential revenue streams. The company needs to explore new areas to expand its offerings, which will allow it to cater to a broader market and increase its revenue.

Furthermore, Infobird Co., Ltd has faced challenges in scaling its business effectively. The company's rapid growth has put pressure on its operations and infrastructure, leading to potential inefficiencies and errors. This has the potential to affect customer satisfaction and impact the company's overall reputation.

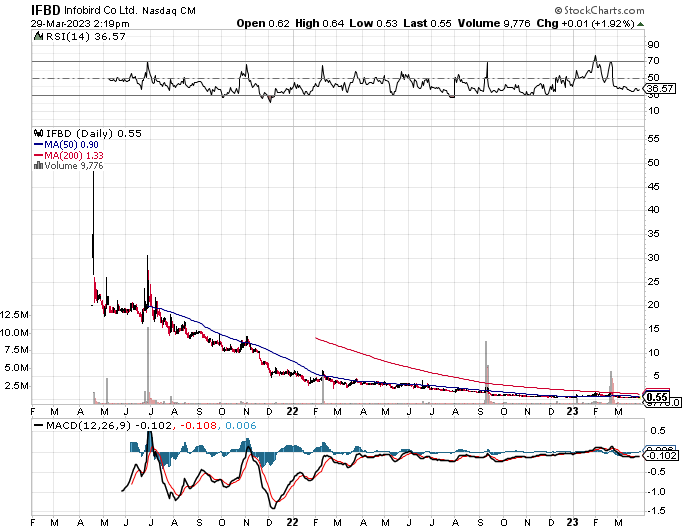

Chart

After taking a quick look at their cash flow trend, it's no surprise that the company just had to raise cash with a direct offering.

Infobird Co., Ltd Announces Pricing of $5 Million Registered Direct Offering

In fact, until their finances improve I would expect this pattern to continue with the share price following suit (down).

Conclusion

In conclusion, while Infobird Co., Ltd is a reputable company in the customer engagement industry, it has some weaknesses that it needs to address. These weaknesses include its heavy reliance on the Chinese market, limited product diversification, and challenges in scaling its operations effectively. By addressing these issues, the company can strengthen its position in the industry and achieve sustainable growth in the long run. However, Chinese companies in general will be facing significant headwinds in the future, and I would be extremely cautious investing in *any of them*.