Intuitive Machines, Inc. (LUNR)

Intuitive Machines, Inc. (LUNR) is a space technology company founded in 2013 and headquartered in Houston, Texas. The company's mission is to create innovative space technologies that will enable humanity to explore and settle the Moon and beyond. In October 2021, the company went public via a special purpose acquisition company (SPAC) merger with publicly traded Inflection Point Acquisition Corp.

Strengths:

Experienced Management Team: Intuitive Machines has a strong management team with a wealth of experience in the space industry. The company's co-founders, Steve Altemus and Tim Crain, have more than 30 years of combined experience in the space industry, and their leadership has been instrumental in guiding the company's growth.

Innovative Technology: Intuitive Machines is developing innovative technologies to support lunar exploration and research. The company is focused on creating a suite of products and services that enable lunar surface mobility, science, and logistics.

Strong Partnerships: Intuitive Machines has formed partnerships with several companies and organizations, including NASA, Lockheed Martin, SpaceX, and Draper. These partnerships provide the company with access to a wide range of resources and expertise that can help accelerate its development and growth.

Diversified Revenue Streams: Intuitive Machines has a diversified revenue stream, with contracts from NASA and other organizations, as well as commercial customers. This diversification reduces the company's reliance on any single source of revenue and helps ensure its long-term financial stability.

Weaknesses:

High Competition: The space industry is highly competitive, with many established players and emerging startups vying for contracts and funding. Intuitive Machines faces competition from companies like Astrobotic, Blue Origin, and SpaceX, among others.

Uncertain Market: The market for lunar exploration and research is still in its early stages, and it's not yet clear how large the market will be or how quickly it will grow. Intuitive Machines may need to navigate shifting market conditions as it seeks to establish itself in the industry.

High R&D Costs: Developing new space technologies is expensive, and Intuitive Machines will need to continue investing heavily in research and development to remain competitive. This can be a challenge, particularly for a small company with limited resources.

Regulatory Challenges: Space exploration is heavily regulated, and Intuitive Machines may face challenges navigating regulatory hurdles as it seeks to develop and deploy new technologies.

Investment Potential:

Intuitive Machines is a company with high growth potential but also faces significant risks and challenges. The company is in the early stages of its growth, and its success will depend on its ability to execute its business plan effectively, secure new contracts, and develop new technologies that meet the needs of the market. However, the company's experienced management team, innovative technology, strong partnerships, and diversified revenue streams are positive indicators for its potential success.

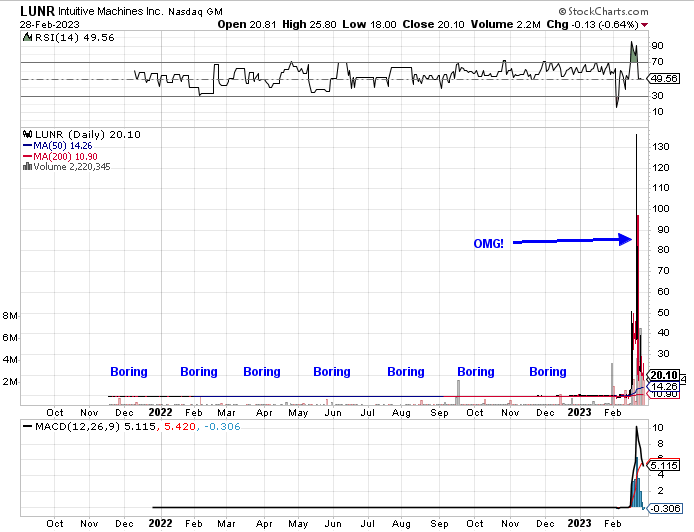

Chart:

This chart pretty much sums up what it's like investing in some of these SPACs. It's kind of like being involved in combat. You wait and wait and wait bored out of your skull and then the proverbial shit hits the fan. In this case, the shit was good.

Quite a move, eh?

What Happened?

The two companies had announced the merger back in September of 2022 so the announcement that the deal had closed on February 13th shouldn't have been a surprise to anyone. But the float is pretty low and there seems to be some appetite for speculative stocks like this coming back into the market. So it went nuts even though they raised less money than anticipated and 30% of the shareholders voted against the merger. Go figure.

What Now?

Now that it's come back down to Earth (pun intended), what now? Should you consider investing in this little space company? Well, that's a tough one. There's no financial history to go on and with such a formidable competitor in SpaceX it's not clear that this company will make it.

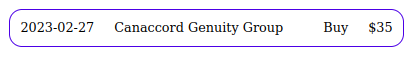

Canaccord Genuity Group stuck their necks out and put a buy target of $35 on it. Take that with a grain of salt, but given the history of volatility so far and the tiny float I wouldn't doubt it one bit.

In fact, I think if you can time this one right it might just go to the moon. ;)