I had written back in mid-November that I had noticed a pattern between fee rate and stock price for Lucid.

"This stock has a pretty high short interest and it is relatively

hard to borrow. Days to cover has been high all year and is at over 8 as

of the last report. Shorts are paying high fees to maintain their

positions as well with fee rates in the teens for most of the year with

occasional spikes much higher.

One interesting thing I noticed as I was looking at the borrow data for

LCID was that spikes in fee rate tend to lead spikes in stock price. Take a look at this 6-month chart below.

This

chart shows the available borrow and fee rate with the stock chart

superimposed on top of it. There has been a spike in fee rate recently

with no corresponding spike in stock price (yet). Will this pattern

continue? Who knows, but it is interesting nonetheless."

Lucid builds electric vehicles and battery systems. They are headquartered in Newark, California.

Lucid went public via a

SPAC merger back in 2021. This was during the bull market, of course, and EV companies were all the rage. I remember looking at their finances at the time and being amazed that a company could be so highly valued with essentially no sales.

But that's what bull markets do for you.

EV Buzz

There's still a lot of excitement about electric vehicles. But the market is more in show-me mode at the moment, and

LCID hasn't really had that much to show for itself.

Well, they did

triple their vehicle production from q2 to q3. Sounds good, right? Except that in q3 they produced only 2,282 vehicles. Granted, these are super nice cars (arguably much nicer than Tesla Model 3s), but that's not very many. And their guidance for the full year is only 6000 - 7000.

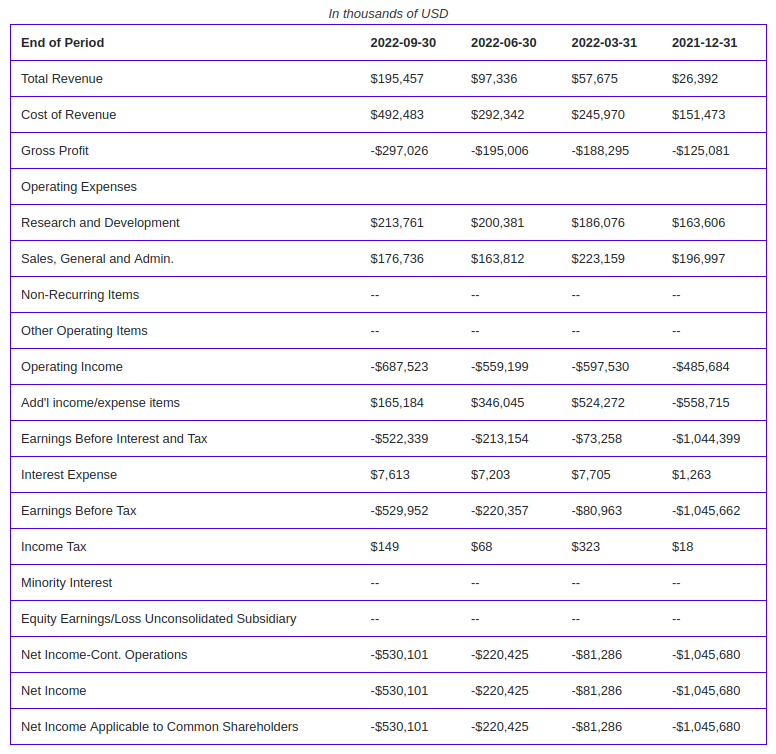

Financials

Lucid is definitely well capitalized. They have consistently lost money since going public, but they do seem to be going in the right direction albeit very slowly. I really don't think there's much fear of them being unable to raise capital in the future, but I suppose you never know. Sales have been increasing nicely and their expenses seem to be under control-- ramping up much more slowly than sales. The real problem I see here is the cost of revenue line. Digging deeper, I pulled this out of their recent

10-Q filed with the SEC:

"Cost of revenue related to vehicle sales primarily include direct parts, materials, shipping and handling costs, allocable overhead costs such as depreciation of manufacturing related equipment and facilities, information technology costs, personnel costs including wages and stock-based compensation, estimated warranty costs and charges to reduce inventories to their net realizable value or charges for inventory obsolescence.

Cost of revenue related to powertrain kits, battery pack systems, supplies and related services for electric vehicles primarily consists of direct parts and materials, shipping and handling costs, personnel costs including wages and stock-based compensation, and estimated warranty costs related to battery pack systems. Cost of battery pack systems also includes allocated overhead costs such as depreciation of manufacturing related equipment and facilities, and information technology costs.

Cost of revenue increased by $489.2 million and $1,027.4 million, respectively, for the three and nine months ended September 30, 2022 as compared to the same periods in the prior year, primarily due to the manufacture and sale of Lucid Air vehicles in 2022. We incurred significant personnel and overhead costs to operate our large-scale manufacturing facilities while ramping up production, with production activity for a limited quantity of vehicles in the three and nine months ended September 30, 2022. In the near term, we expect our production volume of vehicles to continue to be significantly less than our manufacturing capacity. Additionally, we recorded write downs of $186.5 million and $364.6 million, respectively, in the three and nine months ended September 30, 2022 to reduce our inventories to their net realizable values, for any excess or obsolete inventories, and losses from firm purchase commitments. We expect inventory write downs could negatively affect our costs of vehicle sales in upcoming periods in the near term as we ramp production volumes up toward our manufacturing capacity."

So they're gearing up to be a major player at some point in the future, and I suspect with the financial backing they seem to have, they will succeed. The only question is how long it will take.

Short Interest

This stock has a pretty high short interest and it is relatively hard to borrow. Days to cover has been high all year and is at over 8 as of the last report. Shorts are paying high fees to maintain their positions as well with fee rates in the teens for most of the year with occasional spikes much higher.

One interesting thing I noticed as I was looking at the borrow data for

LCID was that spikes in fee rate tend to lead spikes in stock price. Take a look at this 6-month chart below.

This chart shows the available borrow and fee rate with the stock chart superimposed on top of it. There has been a spike in fee rate recently with no corresponding spike in stock price (yet). Will this pattern continue? Who knows, but it is interesting nonetheless.

Bottom Line

It sure looks like every last bit of speculative excess has been wrung out of this stock over the last year. And I think it's pretty safe to say that given their financial backing this company is here to stay. The future is uncertain, of course, so there are no guarantees, but I think if you're willing to wait, this stock could pay off handsomely from here. The real cost will be opportunity cost, however, as it could take a number of years for this company to reach profitability. But as the market's appetite for speculation comes back, EV stocks will soar once again without a doubt.