Update (2022-11-14):

Just wanted to post a quick update on NUTX this morning. It formed a classic Wolfe wave as it fell after the initial surge off its reverse merger earlier this year. The dashed line (formed by joining and extending points 1 and 4) is the price target for this pattern. Notice that it lines up very nicely with the 200-day moving average, which is currently at $4.36. On Friday the stock was up 37% and pierced through its upper Bollinger Band for the first time in months-- a sign of strength. It is natural for a stock to consolidate after this happens. Also notice that the stock price touched the underside of the lower trend line that helps to define the Wolfe wave. The price/volume trend continues to be positive as the stock has been going up strongly on high volume and consolidating on lower volume.

I suspect that when NUTX breaks through that lower trend line it will not take long for it to realize the price target at the dashed line. This is not advice to do anything, but I'm still holding my position at an average price of about $0.76.

Update (2022-10-25):

Nutex continues to show positive price/volume action. The arrows on the chart below show strong up moves on strong relative volume, which is exactly what bulls want to see.

Medium-term Price Targets

I continue to hold this undervalued stock as I watch the positive action unfold. The weekly log chart below shows bullish divergence on the MACD indicator on the bottom pane, and the arrow points to what looks like an imminent bullish MACD crossover. This stock traded as high as $52.80 earlier this year.

I'm expecting a move to the red/blue line area ($3-4). With the stock trading around $0.80 as I write this, it seems like a good risk/reward.

Who are they?

Nutex Health, Inc. (

NUTX) is headquartered in Houston, TX, and is a healthcare management and

operations company founded in 2011. They have over 1500 employees and are partnered with over 800 physicians across 8 states. They have two divisions: a Hospital Division and a

Population Health Management Division.

From their website (

https://www.nutexhealth.com/):

"The Hospital Division owns, develops and

operates innovative health care models, including micro-hospitals,

specialty hospitals, and hospital outpatient departments (HOPDs). This

division owns and operates 21 facilities in 8 states.

The Population Health Management Division

owns and operates provider networks such as Independent Physician

Associations (IPAs). Our Management Services Organizations (MSOs)

provide management, administrative, and other support services to our

physician groups and affiliates. Our cloud-based proprietary technology

platform aggregates data across multiple information systems, settings,

and sources to create a holistic view of each patient and provider,

allowing us to deliver greater quality care more efficiently."

Management

Tom Vo, MD MBA, is the CEO and Chairman of the Board, and he is also the largest shareholder holding about 41% of the outstanding stock. Altogether, insiders hold about 50% of the company so they definitely have skin in the game.

Mr. Vo is residency trained in emergency medicine and has more than 25 years of expertise in the field.

He has been a major contributor to the start-up and management of

over 30 specialty hospitals and emergency centers throughout the US.

Vision

Nutex currently operates 21 micro-hospitals, but within the next 10 years envisions operating over 100 of these nationwide. The trend in healthcare is toward integrated care, and

NUTX is scaling just such a system. The benefits of integrated healthcare are improved patient outcomes and higher operating efficiency for providers. This is a win-win that is quickly becoming the standard of care.

On July 13th of this year the company provided an update to their growth strategy. They indicated that they had opened two new micro-hospitals earlier this year and that these locations were already cash-flow positive. They plan to open 17 more of these in the next two years. They have formed new Independent Physicians Associations (IPAs) in Houston and Miami and anticipate forming another one this year in Phoenix. They further anticipate launching 2-3 of these per year in the future around their existing micro-hospitals.

Micro-hospitals

The typical Nutex hospital has 50 full- and part-time employees, and about 10-20 physicians on staff. They accept all commercial insurance and even Medicare at some locations. They do note that they will treat all patients regardless of insurance status. These micro-hospitals provide about 90% of the company's revenue.

From an interview in August of 2022, Tom Vo said:

"Our micro-hospitals provide 24/7 care and are

equipped with CT, MRI, x-ray, ultrasound, lab and inpatient pharmacies.

Most of our hospitals average 8 ER beds and 4-10 inpatient beds,

although our largest hospital has 44 beds. Our emergency rooms can

handle almost everything that larger hospital ERs manage. Our inpatient

hospital units are capable of treating the most common medical

illnesses as well as behavioral conditions. We do not provide ICU

services, surgeries or obstetric services, although some of our

hospitals have operating rooms."

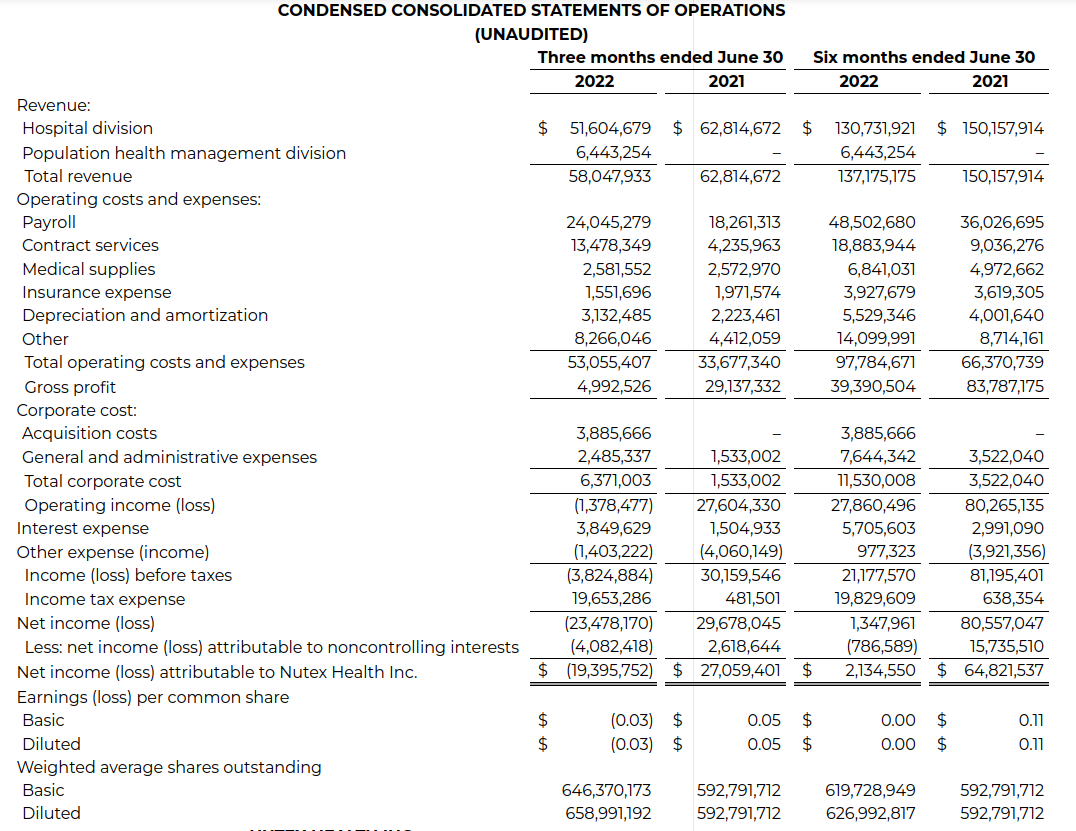

Company Financials

The company has a demonstrated history of profitability. As a result of their acquisition of Clinigence they recorded one-time charges of $23.3 million. Their results for the relevant periods are below. Please see their

press release for more information.

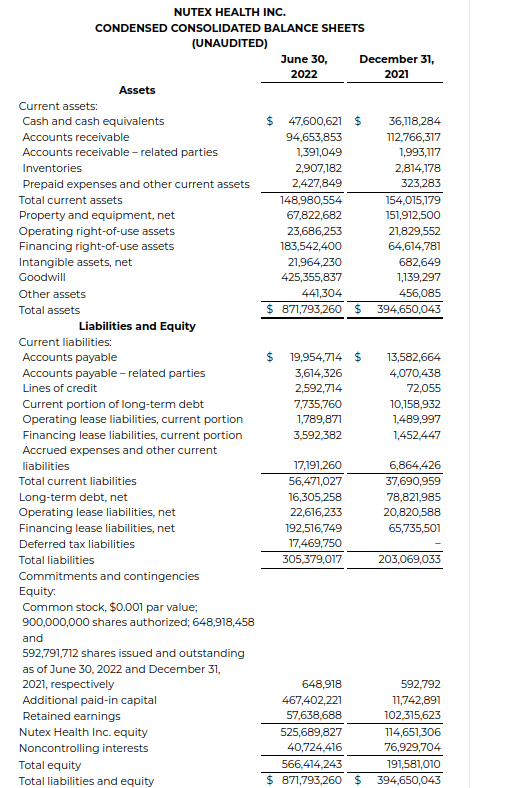

Their balance sheet looks pretty good. As of the most recent quarter their cash and cash equivalents total $47.6 million while their long-term debt is only $16.3 million. And their current ratio of 2.63 and quick ratio of 2.54 indicate good financial health. Also important to note is that as of 10/7 the company is trading below book value.

See their balance sheet below as of June 30th of this year.

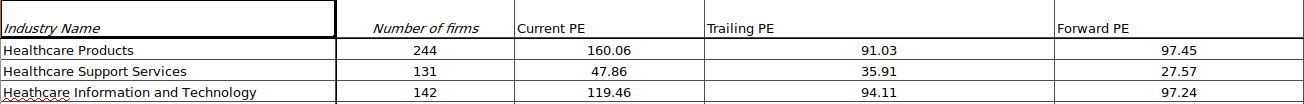

Valuation

Yahoo Finance lists NUTX as being part of the healthcare information services industry.

According to

Aswath Damodaran, professor of corporate finance and valuation at the Stern School of Business at New York who compiles this information, various PE ratios for the relevant healthcare industries are as follows:

Even using the lowest of the three, healthcare support services, anyone can see that

NUTX is undervalued here. Backing out the one-time charges and annualizing their net income yields an expected full-year earnings per share of about $0.16. At a forward PE of 27 that values the stock at over $4/share.

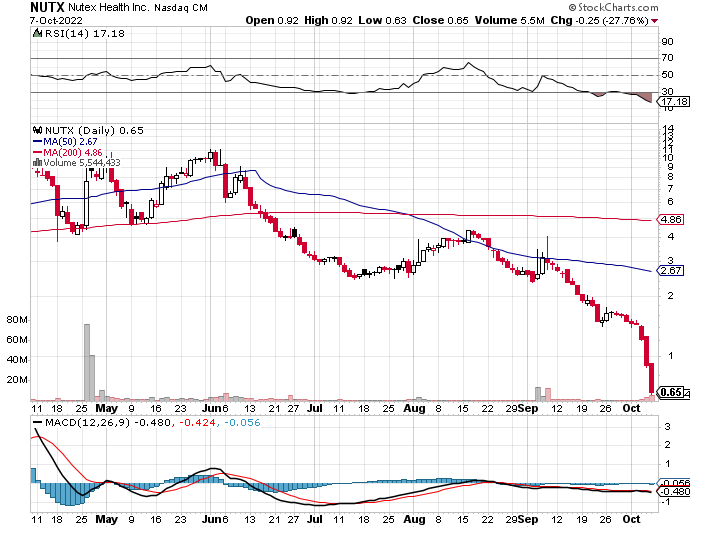

Chart

As of the close on 10/7, the stocks sits at a mere $0.65. Wow.

One insider, Warren Hosseinion, who became President of the company after the completed merger with Clinigence, has been selling his stock with reckless abandon.

Who knows why he may be selling? In any case, he started selling at the beginning of September and from the looks of the chart above he just about single-handedly caused the recent weakness in the stock. Even if he's selling it all, it won't take him much longer at this rate to be completely done. There has been no other appreciable insider selling over the last year. See table below.

I have taken a small speculative long position in this undervalued and under-appreciated name.