ThermoGenesis Holdings, Inc. (THMO)

ThermoGenesis Holdings, Inc. (

THMO) is a medical technology company that develops and commercializes automated cell processing technologies and products for cell and gene-based therapies. The company is headquartered in Rancho Cordova, California, and was founded in 1986. ThermoGenesis operates through two primary business segments: Cell Processing and Cord Blood.

The Cell Processing segment offers a range of automated systems for the isolation, collection, and processing of stem cells from various sources, including bone marrow, peripheral blood, and umbilical cord blood. The segment's flagship product is the AXP® AutoXpress® Platform, an automated device that isolates and concentrates stem cells from umbilical cord blood. The AXP® platform is designed to provide rapid and efficient processing of cord blood units for transplantation, with a high yield of viable stem cells.

The Cord Blood segment offers a comprehensive range of products and services related to cord blood banking, including collection kits, cryopreservation bags, and storage containers. The segment's flagship product is the CryoSeal® FS System, a proprietary device that is used to freeze and preserve cord blood stem cells. The CryoSeal® FS System is designed to ensure the long-term viability and potency of cord blood stem cells, which can be used in a variety of therapeutic applications.

ThermoGenesis Holdings, Inc. is in the business of providing innovative medical technologies and products for the cell and gene-based therapy industry. With the ever-growing demand for regenerative medicine and the need for cell-based therapies, ThermoGenesis has positioned itself to become a leader in the market. The company's product line focuses on the automation of cell processing, which helps to reduce the risks of human error and ensure the purity and potency of cells, leading to higher success rates in cell-based therapies.

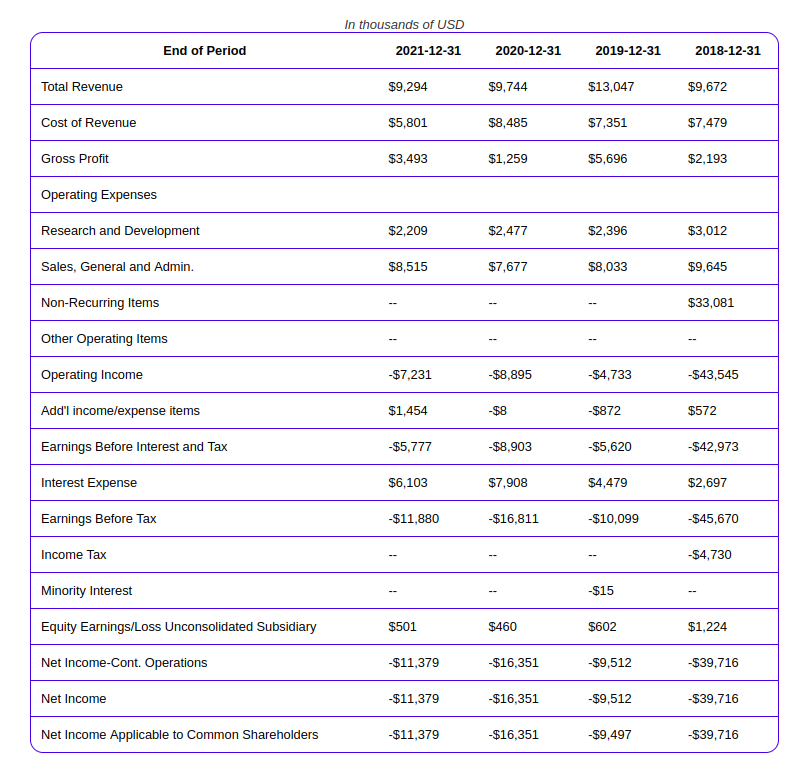

ThermoGenesis Holdings, Inc.'s financial position is stable, with consistent revenue growth in recent years. According to the company's financial reports for the year ended 2021, total revenue for the year was $9.3 million, which represents a 4% decrease compared to the previous year. Their annual income statements are shown below for the last four years.

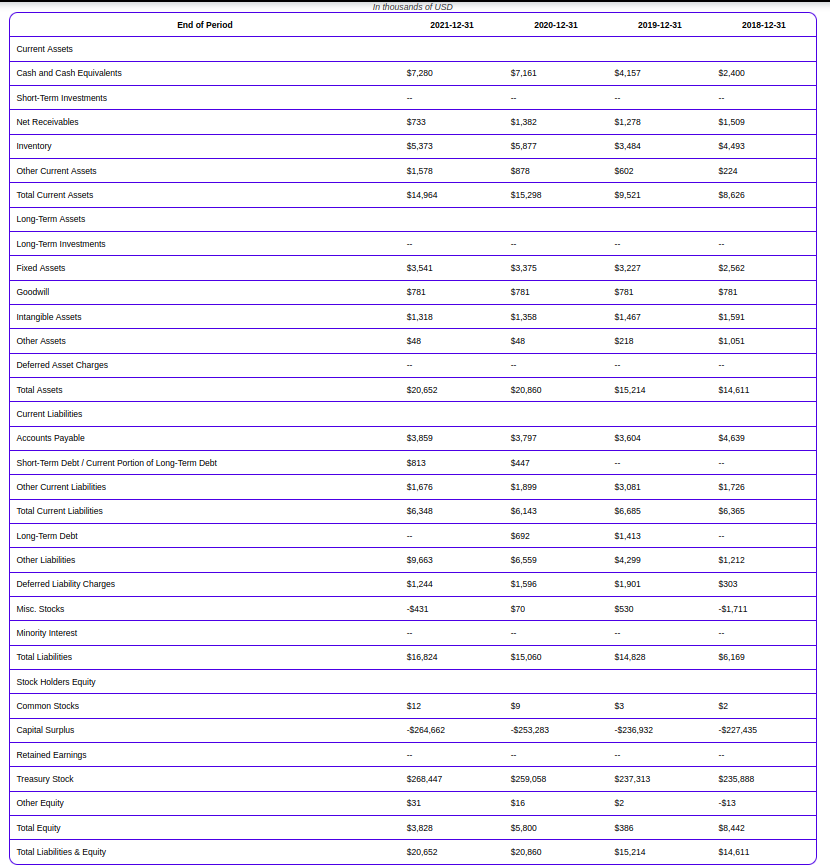

ThermoGenesis Holdings, Inc. has a decent balance sheet, with total assets of $20.6 million and total liabilities of $16.8 million. The company has a healthy cash balance of $7.3 million, which provides the company with the resources to fund its ongoing operations and investments in product development. But looking at the yearly losses above it is clear the company will once again raise cash to cover the shortfall. These numbers are as of the year ended 2021-12-31, which is shown below along with the previous three years.

ThermoGenesis Holdings, Inc.'s management team is experienced and knowledgeable in the cell and gene-based therapy industry, with a proven track record of success in developing and commercializing medical technologies. The company's CEO, Chris Xu, has over 20 years of experience in the medical device industry, with a focus on cell therapy and regenerative medicine. The company's Chief Scientific Officer, Dr. Xiaochun "Chris" Xu, is a renowned expert in stem cell biology and has authored numerous scientific publications in the field.

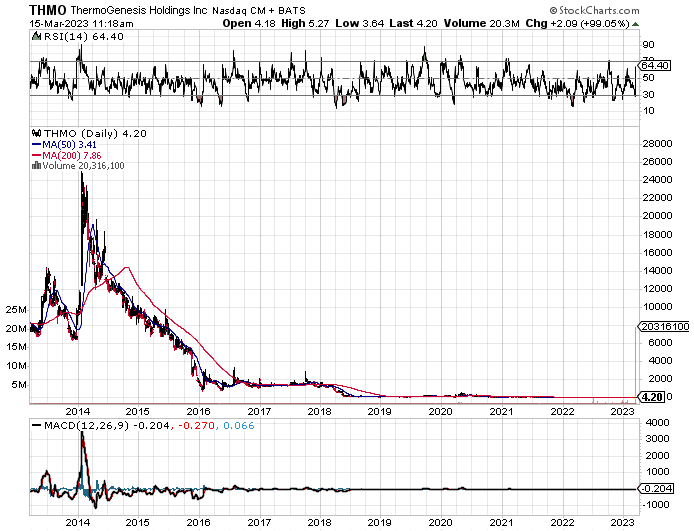

Here's a chart of THMO's entire time as a public company. It's a doozy. But they went to $26,100/share, you say! Yes, but that's split adjusted. They've had 3 reverse splits for the duration of that chart: 1:20 in 2016, 1:10 in 2019, and a whopping 1:45 in 2022. So the $26,100 price you see is $2.90 split adjusted. This is a sign of a failed company.

In conclusion, ThermoGenesis Holdings, Inc. is a promising medical technology company that provides innovative products and services for the cell and gene-based therapy industry. With a stable financial position, experienced management team, and strong product portfolio, the company is well-positioned to capitalize on the growing demand for regenerative medicine and advancements in cell processing technologies. As the industry continues to grow, ThermoGenesis Holdings, Inc. is expected to play an important role in shaping the future of healthcare. That all may be true-ish, but I think the only real opportunity here is

maybe for a trade. I definitely would not hold it long term.