Troika Media Group (TRKA)

Troika Media Group is a company that specializes in branding, advertising, and marketing services. They offer a range of services to clients across various industries, including entertainment, sports, and technology. The company is headquartered in Los Angeles and was founded in 2001.

Its long and illustrious time as a public company can be summed up in the following chart:

Nice. OK, not really.

There are several reasons why you might consider buying Troika Media Group stock, however. Here are some key points to consider:

Strong track record of growth: Troika has experienced strong revenue growth in recent years, with revenue increasing from $16.3 million in 2016 to $116.4 million in 2022. This growth has been driven by increased demand for the company's services, as well as successful acquisitions.

Diversified revenue streams: Troika has a diverse set of revenue streams, which helps to mitigate risk. The company generates revenue from branding and design services, advertising and marketing services, and technology solutions. This diversification means that even if one area of the business experiences a downturn, the company can still generate revenue from other areas.

Strong client relationships: Troika has established strong relationships with many of its clients, which include major brands like the NBA, NFL, and Amazon. These relationships have led to repeat business and referrals, which can help to drive future growth.

Strategic acquisitions: Troika has made several strategic acquisitions in recent years, including the acquisition of Mission Media in 2019. These acquisitions have helped the company to expand its capabilities and reach, and to better serve its clients.

Favorable industry trends: The branding and marketing industry is expected to continue growing in the coming years, driven by increasing demand for digital marketing and advertising services. Troika is well-positioned to benefit from these trends, given its focus on technology solutions and its strong digital capabilities.

Experienced management team: Troika is led by an experienced management team, with a track record of success in the industry. This team has a deep understanding of the company's operations and the industry as a whole, which should help to guide the company's growth and success in the future.

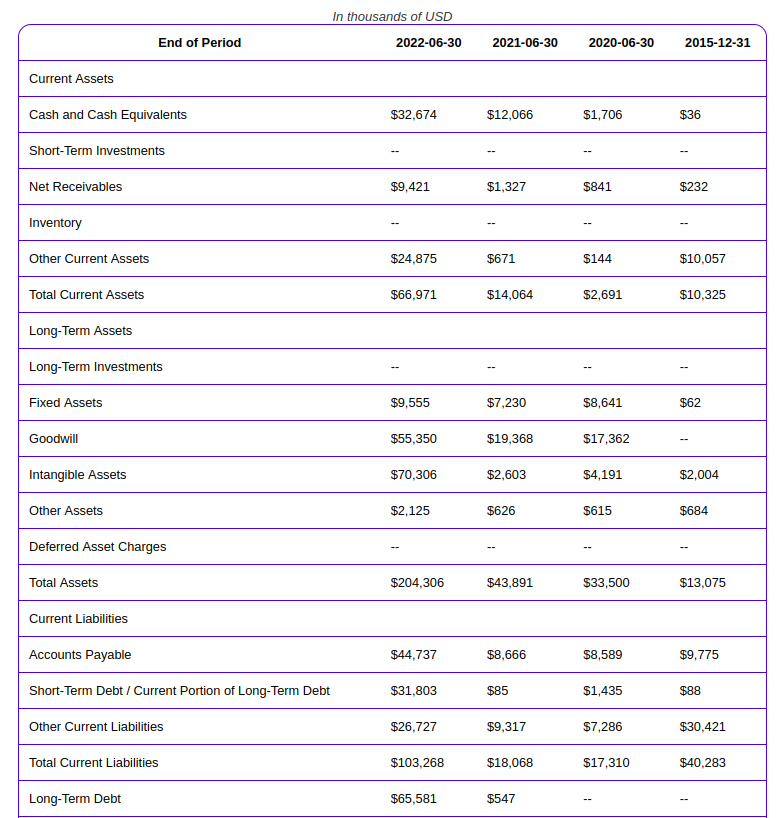

Now, before you take any of that as the gospel truth you should consider the following items from their balance sheet.

Their current ratio (current assets / current liabilities) possibly indicates a need for more cash in the near future and is a potential red flag. They are, however, trading under their cash level per share of about $0.48. Given that cash level per share it is kind of hard to believe that they recently traded as low as $0.10.

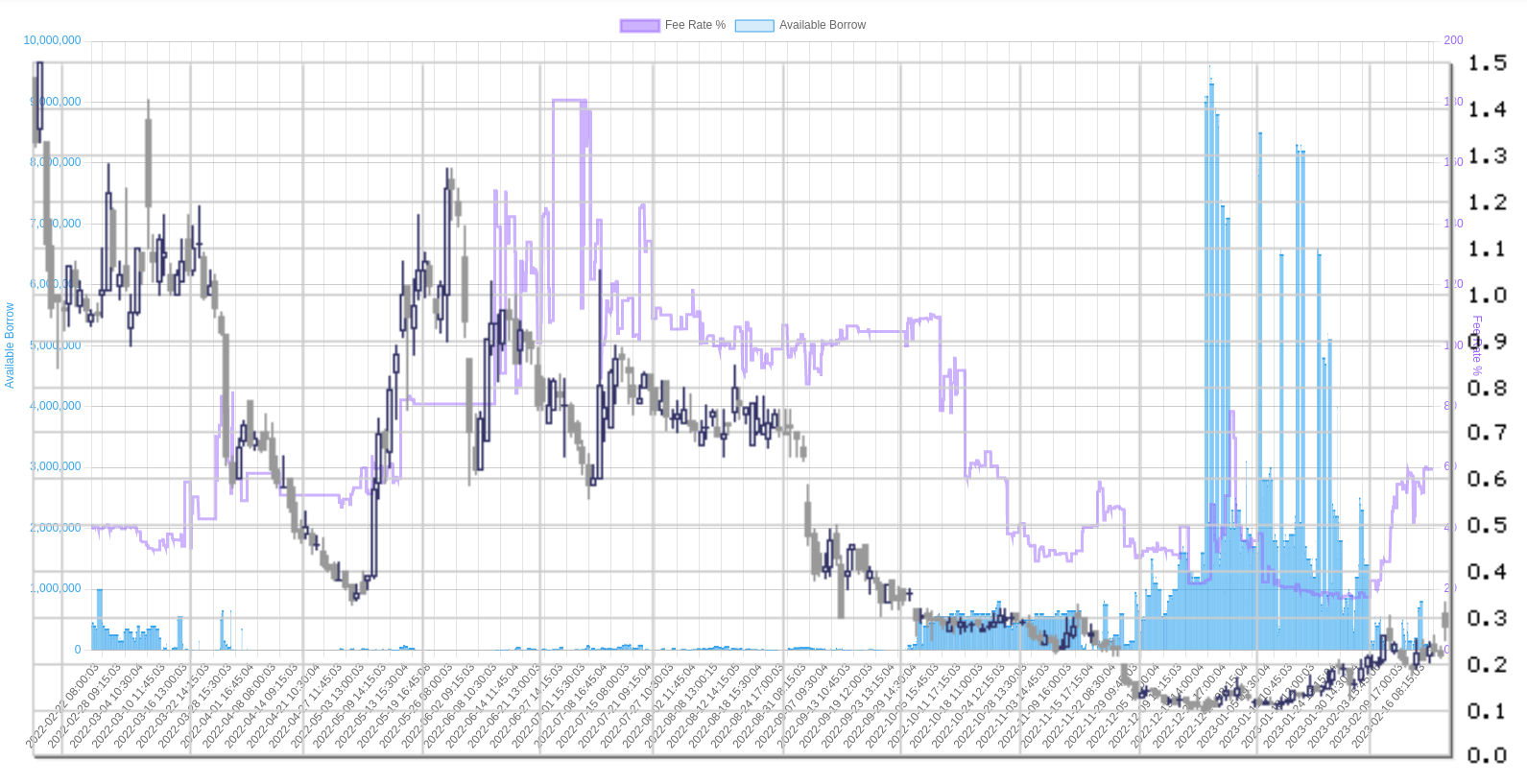

Big volume today indicates that something may be up and looking a little closer I see that there are no shares available to borrow.

The following chart shows the stock chart over the available borrow and fee rate for the last year. The stock price tends to track the fee rate so it will be interesting to see what happens over the coming sessions with both.

This stock looks pretty risky to me, but with it trading under cash and difficult to short it may be worth that risk for a long position. I'll be watching it closely.