You may not need one. They're not for everyone. A lot of people have difficulty making difficult decisions (such as taking a stop loss), and therefore can benefit from a stock trading system that works without emotion. On the other hand it is sometimes difficult to make a decision to buy. After all, the best time to buy is very often when sentiment is at an extreme low, and by definition people generally don't feel very good at those times.

Self-designed and -directed Stock Trading System

This type of stock trading system is designed by the individual investor him- or herself. You subscribe to a service that allows you to create trading strategies based on fundamental and technical analysis. Oftentimes, these require the use of proprietary programming languages. This type of stock trading system is extremely difficult for the average investor. Not only must you develop a stock trading system that makes money over time, you must also backtest it to be sure that it works in every time frame. The benefit of this type of stock trading system is that the user has full control.

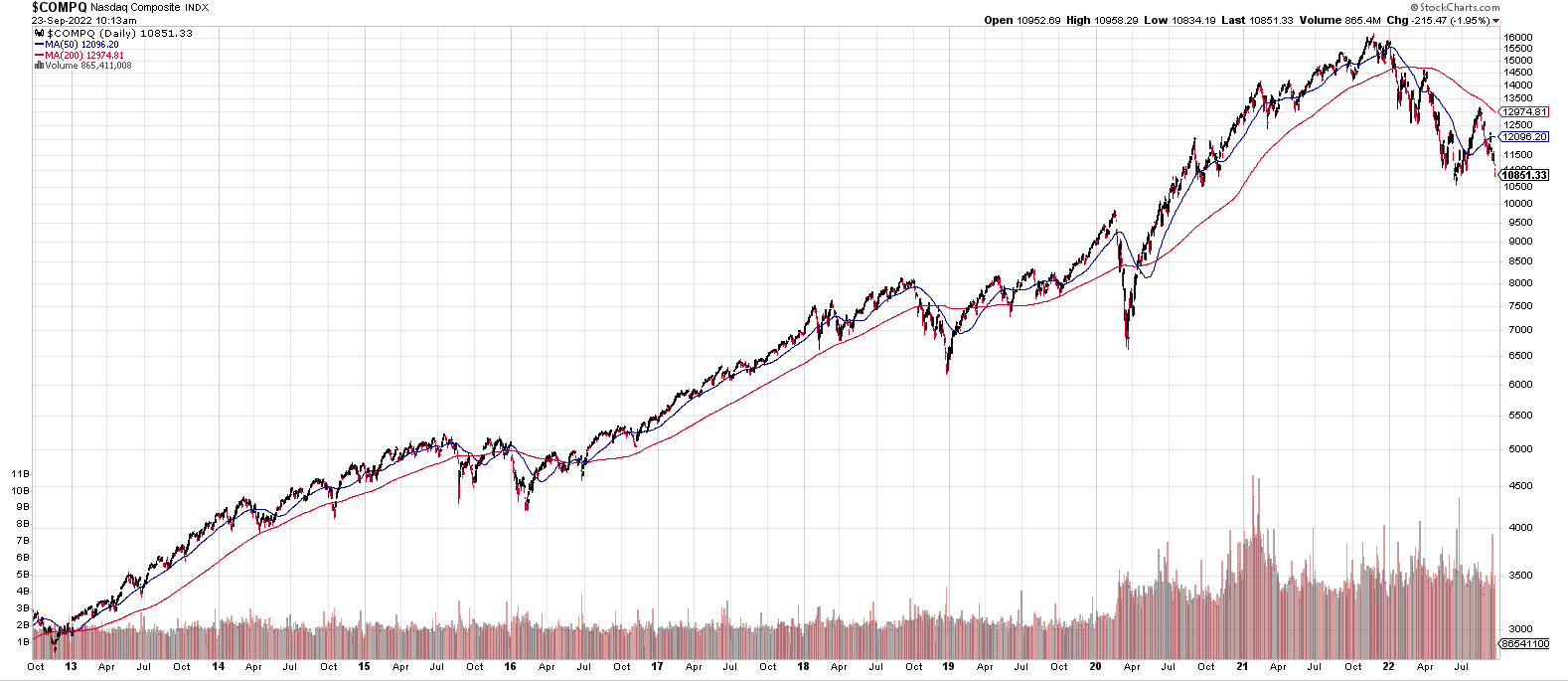

A quick example of a rigid and rules-based stock trading system is in the chart below. A buy signal is generated when the 50-day simple moving average (SMA), the blue line, crosses above the 200-day SMA, the red line, and a sell signal is generated when the blue line crosses below the red line. At first glance, it may seem that something like this would work well. The reality is that there is too much of a lag in the signals. When people talk about the golden cross and the death cross, they are talking about this.

Flexible Stock Trading Systems

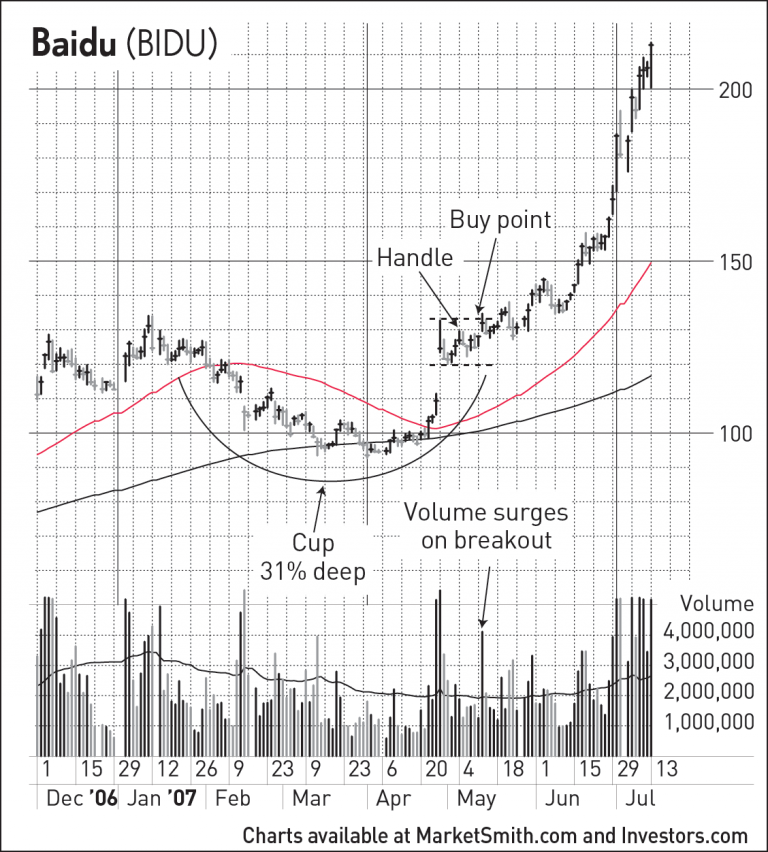

These types of stock trading systems are based on patterns. You will hear lots of colorful names thrown about when people talk about stocks. Cup-with-handle, high tight flag, rising wedge, falling wedge, you name it. There are hundreds of them! It takes a lot of study to learn these various patterns. Then, it takes a lot of practice to see how well they work in the real world. This type of stock trading system is much more difficult to backtest, because they are so flexible. Computer programs make decisions on a fixed rule set, and this type of stock trading system is the antithesis of that by design.

Here's a quick example of a common pattern that you will hear when discussing a flexible stock trading system. This is William O'Neil's famous cup-with-handle pattern applied to the stock Baidu (

BIDU). There are rules involved in recognizing this type of pattern, of course, but they are very subjective.

They say things like:

- There must be at least a 30% uptrend, but it has to be before the base starts.

- The total time of the cup with handle must be at least seven weeks, but it can only be six weeks if there's no handle.

- The handle has to be at least five days long, but it can be weeks and weeks long.

- There are "rules" based on the depth of the cup and the depth of the handle.

These things are all subjective and can lead a trader to indecision. This trading pattern has been very successful, however, and continues to demonstrate great performance for those people willing to put in the time and effort to learning it and applying it to thousands of stocks to find a potential winner.

Another type of trading pattern for a flexible stock trading system is a declining or falling wedge. The idea with this pattern is that you need to recognize certain things happening on the chart and then decide when the time is right to make a trade.

There's a requirement that there be a prior trend, that there must be two converging trend lines (as shown in the image below), and then a breakout accompanied by large volume. This is another great pattern that people have successfully used as part of a flexible stock trading system, but keep in mind that is also pretty subjective. How much volume is enough volume? What about the converging trend lines? What if they aren't picture perfect like the example below?

Black Box Stock Trading Systems

This leads us to the final type of stock trading system-- the

black box stock trading system. You can see the input for the stock trading system (your stock symbol), and you can see the output of the stock trading system (when to buy and sell), but you don't see any of the rules that the stock trading system employs. This is by far the most popular type of stock trading system out there. People have a lot of incentive to create a stock trading system that works. The problem is that it is extremely difficult to do. And because they are black boxes and come with the usual performance disclaimers there's no way of knowing whether a stock trading system is any good.

Or is there a way to know if a stock trading system is any good?

The key to instilling confidence in any black box stock trading system is transparency. Not about exactly how the stock trading system works, but how it performs over time. Any stock trading system worthy of consideration must tell you how it's done in the past so you have an idea how it will do in the future. Simple, right? The problem is that many stock trading systems will purposely obfuscate their performance statistics because, well, they're probably not very good. Let's face it: If every stock trading system out there was good, there would be a lot more billionaires in the world. So, how well has it done in the past? Preferably the black box stock trading system should show exactly when trades were executed including losses and stop losses. There is a fine line between transparency for instilling confidence and transparency that gives too much information about the secret inner workings of the stock trading system so be aware that there's a limit here.

Simulated Performance

It is also a really good idea to put the system through a randomized performance simulator, a process that is common in statistics called bootstrapping. This is a relatively simple but extremely powerful technique for increasing the stability of any statistical result. Nothing is guaranteed, of course, but bootstrapping generates asymptotically consistent results. The down side of this powerful technique is that is not widely known, it's difficult to implement, it's extremely resource heavy while doing the tests, and there's really not much available software that does this type of analysis. Generally speaking, if you're going to do any bootstrapping of your stock trading system, you're on your own. But it is extremely important to do!

Shortable Stocks Trading System

So our

trading system is a black box. You won't learn how it works, because it's proprietary and valuable. It's the result of literally decades of market study. But it also benefits because of the unique abilities of our team. We are programmers at heart and have been for even longer than we've been trading. We are also statisticians. The stock trading system we have developed is robust and extremely well tested. It has been demonstrated to work well in every environment we've seen in the past thirty years or so. We pride ourselves on providing transparency. You will be able to see every trade the stock trading system has made for any stock you want that we cover. The only thing that is limited in this regard is that we don't show trades executed within the last three months, because we feel that that could give away too much of the inner workings of the stock trading system.

Easy To Use

Our stock trading system is extremely easy to use. In fact, it was designed in such a way that you can use it even if you don't have time to watch the market all day. Like if you have a 9 to 5 job. We really have gone out of our way to make this stock trading system accessible to everyone. The general idea is that you can build a list of 50 stocks that the stock trading system watches for you on a daily basis. We even help you build that list based on the performance metrics of the past. Nothing is guaranteed, of course, but past performance is the best indication for the future. The stock trading system will then tell you what to do with every stock after the close of every market day. The trades to be executed will always happen at the open of the next market day meaning that you can manage your portfolio in just a few minutes every evening. Standing stop loss orders must be entered along with any purchase as the stock trading system instructs you to do. The stock trading system uses no margin and encourages diversification so risk management is built-in by design.

There's a reason why we have so many satisfied customers. It's because this stock trading system is helping them to consistently make money.